Build credit while building savings

Boost your score by 60+ points with no credit check required. Start from $10/month and get 100% of your money back.

+60 Points

FDIC Insured

100% Back

🔒 No credit check • Free to start • Cancel anytime

|

How it works

Four simple steps to transform your credit

Our Credit Builder Loan makes it easy to improve your credit score while saving money for your future

Choose Your Plan

Select a monthly payment that fits your budget

Start building credit for as little as $10/month. No credit check required - everyone is approved!

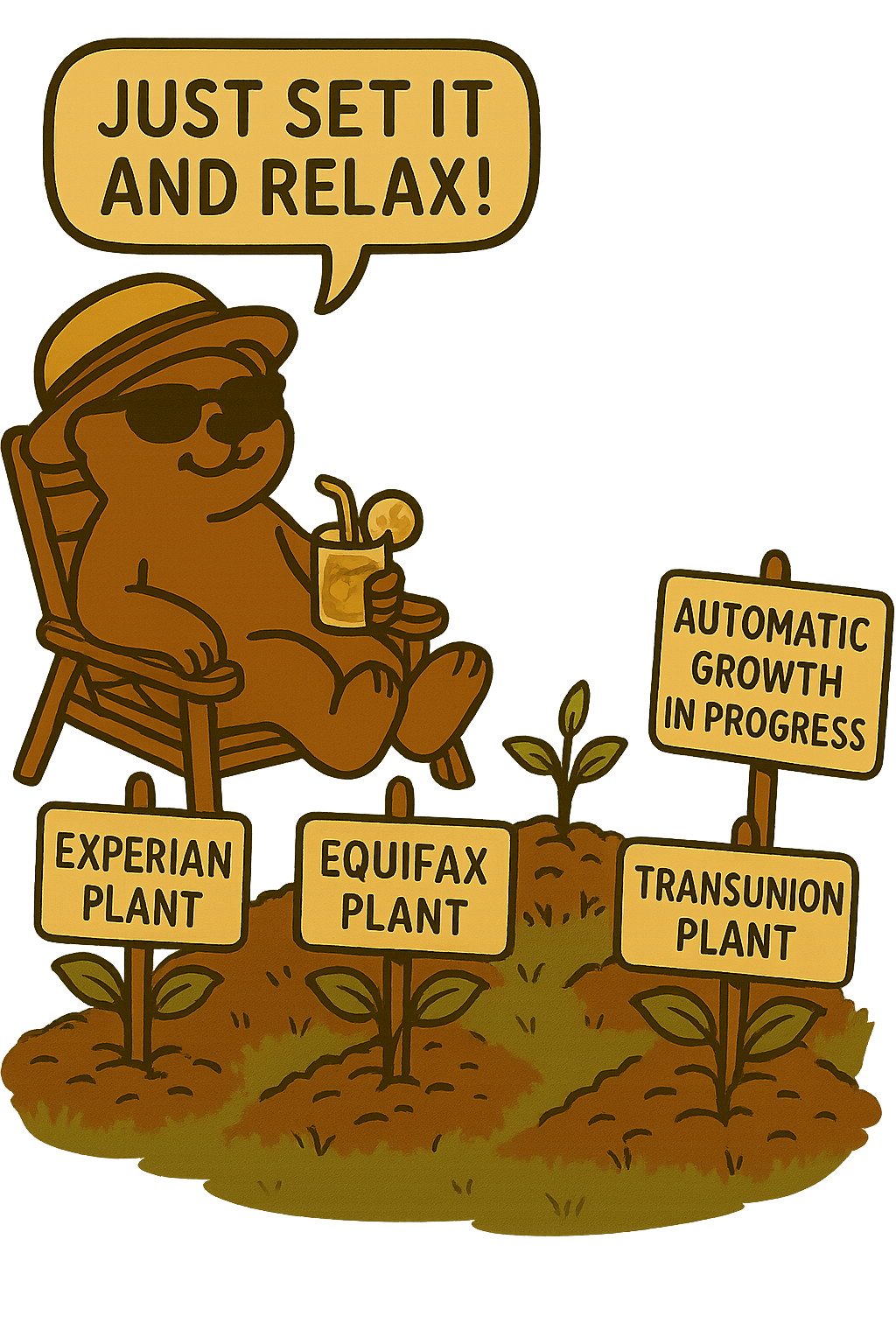

Set & Forget

We handle everything automatically

Set up automatic payments and watch your positive payment history build. We report to all three major bureaus every month.

Save While Building

Your payments grow into savings

Unlike traditional loans, your payments are held in an FDIC-insured savings account. Build credit while building your emergency fund!

Unlock Your Future

Access your savings and improved credit

After 12 months, get 100% of your payments back plus your improved credit score. Use your new score to qualify for better rates!

SUCCESS RATE

98%

of members see credit improvement

AVERAGE TIME

3-6

months to see results

TOTAL SAVED

$2.1M

by our members so far

Why Choose Sable

The smart way to build credit

Everything you need to improve your credit score and build your savings at the same time

Proven Results

Our members see real credit score improvements with consistent use.

Average 60 point increase

Results in 3-6 months

Track progress in real-time

Safe & Secure

Your money is protected and insured while you build credit.

FDIC insured up to $250,000

Bank-level encryption

No hidden fees

Build Savings

Unlike traditional loans, you get your money back at the end.

100% of payments returned

Build emergency fund

Earn while you save

All 3 Bureaus

Your positive payment history reports to all major credit bureaus.

Reports to Experian

Reports to Equifax

Reports to TransUnion

Flexible Terms

Choose a plan that fits your budget and timeline.

Start at $10/month

12 or 24 month terms

Change or cancel anytime

Support & Education

Get guidance and resources to maximize your credit building journey.

24/7 customer support

Credit education resources

Personalized tips

Join 50,000+ members building better credit

Average increase

Savings goal

Money back

Frequently Asked Questions

Got questions? We've got answers

Everything you need to know about building credit with Sable

Ready to transform your financial future?

Join thousands of members who are building better credit and saving for their future. Start your journey today with no credit check required.

60+

Point Increase

$10

Monthly Min

100%

Money Back

No credit check • Cancel anytime • FDIC insured

MEMBER SUCCESS

"My credit score went from 560 to 642 in just 6 months!"

Sarah M., Sable Member